Uruchom w Google Colab Uruchom w Google Colab |  Zobacz źródło w GitHub Zobacz źródło w GitHub |

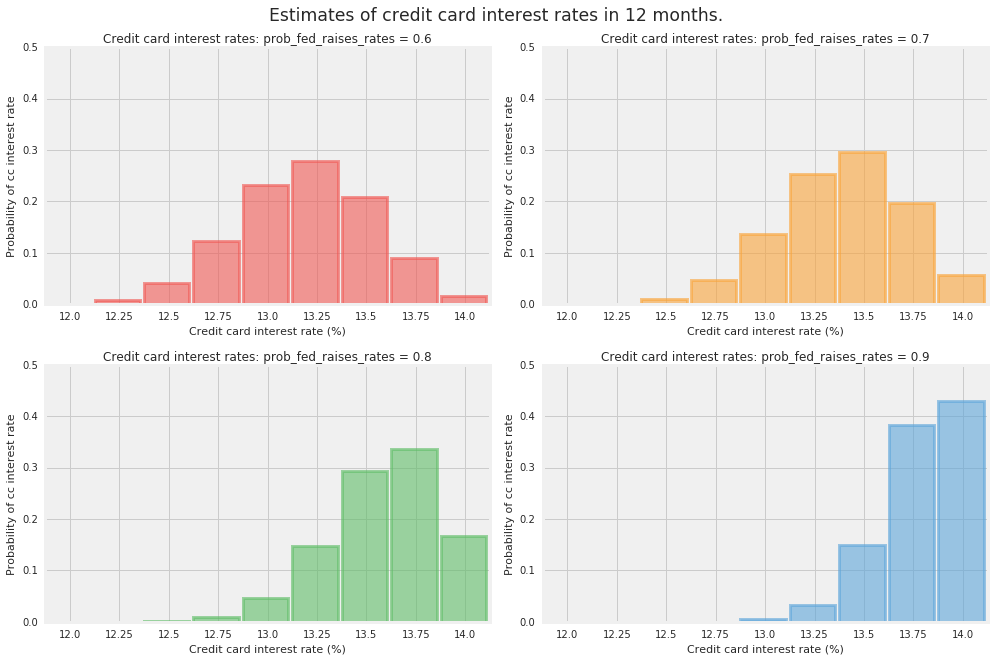

Wyobraźmy sobie, że chcesz oszacować oprocentowanie swojej karty kredytowej za rok. Załóżmy, że aktualna stawka główna wynosi 2%, a wystawca karty kredytowej pobiera opłatę w wysokości 10% plus prime. Biorąc pod uwagę siłę obecnej gospodarki, uważa Pan, że Rezerwa Federalna jest bardziej skłonna do podniesienia stóp procentowych niż do podniesienia stóp procentowych. Fed zbierze się osiem razy w ciągu najbliższych dwunastu miesięcy i albo podniesie stopę funduszy federalnych o 0,25%, albo pozostawi ją na dotychczasowym poziomie.

Do modelowania stopy procentowej Twojej karty kredytowej na koniec dwunastomiesięcznego okresu używamy rozkładu dwumianowego. W szczególności użyjemy klasy rozkładu dwumianu prawdopodobieństwa TensorFlow z następującymi parametrami: total_count = 8 (liczba prób lub spotkań), probs = {.6, .7, .8, .9} dla naszego zakresu szacunków dotyczących prawdopodobieństwo podniesienia przez Fed stopy funduszy federalnych o 0,25% na każdym posiedzeniu.

Zależności i wymagania wstępne

Ustawienia instalacji TensorFlow Prawdopodobieństwo

TFP_Installation = "Stable TFP"

if TFP_Installation == "Most Recent TFP":

!pip install -q tfp-nightly

print("Most recent TFP version installed")

elif TFP_Installation == "Stable TFP":

!pip install -q --upgrade tensorflow-probability

print("Up-to-date, stable TFP version installed")

elif TFP_Installation == "Stable TFP-GPU":

!pip install -q --upgrade tensorflow-probability-gpu

print("Up-to-date, stable TFP-GPU version installed")

print("(make sure GPU is properly configured)")

elif TFP_Installation == "Most Recent TFP-GPU":

!pip install -q tfp-nightly-gpu

print("Most recent TFP-GPU version installed")

print("(make sure GPU is properly configured)")

elif TFP_Installation == "TFP Already Installed":

print("TFP already installed in this environment")

pass

else:

print("Installation Error: Please select a viable TFP installation option.")

Importy i zmienne globalne (upewnij się, że uruchomiłeś tę komórkę)

from __future__ import absolute_import, division, print_function

warning_status = "ignore"

import warnings

warnings.filterwarnings(warning_status)

with warnings.catch_warnings():

warnings.filterwarnings(warning_status, category=DeprecationWarning)

warnings.filterwarnings(warning_status, category=UserWarning)

import numpy as np

import os

matplotlib_style = 'fivethirtyeight'

import matplotlib.pyplot as plt; plt.style.use(matplotlib_style)

import matplotlib.axes as axes;

from matplotlib.patches import Ellipse

%matplotlib inline

import seaborn as sns; sns.set_context('notebook')

notebook_screen_res = 'png'

%config InlineBackend.figure_format = notebook_screen_res

import tensorflow as tf

# Eager Execution

use_tf_eager = True

# Use try/except so we can easily re-execute the whole notebook.

if use_tf_eager:

try:

tf.compat.v1.enable_eager_execution()

except:

reset_session()

import tensorflow_probability as tfp

tfd = tfp.distributions

tfb = tfp.bijectors

def default_session_options(enable_gpu_ram_resizing=True,

enable_xla=False):

"""Creates default options for Graph-mode session."""

config = tf.ConfigProto()

config.log_device_placement = True

if enable_gpu_ram_resizing:

# `allow_growth=True` makes it possible to connect multiple

# colabs to your GPU. Otherwise the colab malloc's all GPU ram.

config.gpu_options.allow_growth = True

if enable_xla:

# Enable on XLA. https://www.tensorflow.org/performance/xla/.

config.graph_options.optimizer_options.global_jit_level = (

tf.OptimizerOptions.ON_1)

return config

def reset_session(options=None):

"""Creates a new global, interactive session in Graph-mode."""

if tf.executing_eagerly():

return

global sess

try:

tf.reset_default_graph()

sess.close()

except:

pass

if options is None:

options = default_session_options()

sess = tf.InteractiveSession(config=options)

def evaluate(tensors):

"""Evaluates Tensor or EagerTensor to Numpy `ndarray`s.

Args:

tensors: Object of `Tensor` or EagerTensor`s; can be `list`, `tuple`,

`namedtuple` or combinations thereof.

Returns:

ndarrays: Object with same structure as `tensors` except with `Tensor` or

`EagerTensor`s replaced by Numpy `ndarray`s.

"""

if tf.executing_eagerly():

return tf.contrib.framework.nest.pack_sequence_as(

tensors,

[t.numpy() if tf.contrib.framework.is_tensor(t) else t

for t in tf.contrib.framework.nest.flatten(tensors)])

return sess.run(tensors)

class _TFColor(object):

"""Enum of colors used in TF docs."""

red = '#F15854'

blue = '#5DA5DA'

orange = '#FAA43A'

green = '#60BD68'

pink = '#F17CB0'

brown = '#B2912F'

purple = '#B276B2'

yellow = '#DECF3F'

gray = '#4D4D4D'

def __getitem__(self, i):

return [

self.red,

self.orange,

self.green,

self.blue,

self.pink,

self.brown,

self.purple,

self.yellow,

self.gray,

][i % 9]

TFColor = _TFColor()

Oblicz prawdopodobieństwa

Oblicz prawdopodobieństwo możliwych stóp procentowych karty kredytowej w ciągu 12 miesięcy.

# First we encode our assumptions.

num_times_fed_meets_per_year = 8.

possible_fed_increases = tf.range(

start=0.,

limit=num_times_fed_meets_per_year + 1)

possible_cc_interest_rates = 2. + 10. + 0.25 * possible_fed_increases

prob_fed_raises_rates = tf.constant([0.6, 0.7, 0.8, 0.9]) # Wild guesses.

# Now we use TFP to compute probabilities in a vectorized manner.

# Pad a dim so we broadcast fed probs against CC interest rates.

prob_fed_raises_rates = prob_fed_raises_rates[..., tf.newaxis]

prob_cc_interest_rate = tfd.Binomial(

total_count=num_times_fed_meets_per_year,

probs=prob_fed_raises_rates).prob(possible_fed_increases)

Wykonaj kod TF

# Convert from TF to numpy.

[

possible_cc_interest_rates_,

prob_cc_interest_rate_,

prob_fed_raises_rates_,

] = evaluate([

possible_cc_interest_rates,

prob_cc_interest_rate,

prob_fed_raises_rates,

])

Wizualizuj wyniki

plt.figure(figsize=(14, 9))

for i, pf in enumerate(prob_fed_raises_rates_):

plt.subplot(2, 2, i+1)

plt.bar(possible_cc_interest_rates_,

prob_cc_interest_rate_[i],

color=TFColor[i],

width=0.23,

label="$p = {:.1f}$".format(pf[0]),

alpha=0.6,

edgecolor=TFColor[i],

lw="3")

plt.xticks(possible_cc_interest_rates_ + 0.125, possible_cc_interest_rates_)

plt.xlim(12, 14.25)

plt.ylim(0, 0.5)

plt.ylabel("Probability of cc interest rate")

plt.xlabel("Credit card interest rate (%)")

plt.title("Credit card interest rates: "

"prob_fed_raises_rates = {:.1f}".format(pf[0]));

plt.suptitle("Estimates of credit card interest rates in 12 months.",

fontsize="x-large",

y=1.02)

plt.tight_layout()